Your Portfolio Works While You Sleep (Free Bots Nobody Talks About)

Your Portfolio Works While You Sleep (Free Bots Nobody Talks About)

Set it up once. Walk away. Let robots do the chart-staring.

The “I Did The Research So You Don’t Have To” Drop

One read. Every free crypto bot that actually works. Copy-paste commands. Zero coding needed for most.

Why you should care even if you know nothing:

Charts move 24/7. You don’t.

These bots buy the dips and sell the rips while you sleep.

The good ones cost exactly $0.

10+ free bots — not the same recycled garbage everyone posts

10+ free bots — not the same recycled garbage everyone posts Copy-paste setup — running in minutes, not days

Copy-paste setup — running in minutes, not days Hidden gems — stuff that took actual digging to find

Hidden gems — stuff that took actual digging to find Honest ratings — what’s easy vs what’s powerful (not the same thing)

Honest ratings — what’s easy vs what’s powerful (not the same thing) Security check — which ones touch your funds vs which don’t

Security check — which ones touch your funds vs which don’t “Just tell me which one” — skip to the answer for your situation

“Just tell me which one” — skip to the answer for your situation

The 5-Second Answer

“I want buttons, not terminals” → Pionex

“I want open-source with a real interface” → OctoBot

“I want maximum control and I’ll learn” → Freqtrade

Keep scrolling for the full breakdown. Or don’t. Your call.

THE ACTUAL BEST ONES

THE ACTUAL BEST ONES

1. Pionex — Click Buttons, Make Money (Maybe)

An exchange with 16 free bots built in. No subscription. No code. Just… click things.

Show me everything

What you pay:

- Monthly fee: $0 forever

- Bot access: $0 for all 16

- Trading fee: 0.05% (lower than most exchanges)

- Surprise fees: None

The bots (all free):

| Bot | Plain English |

|---|---|

| Grid Bot | Buys when price drops, sells when it rises. Repeats forever. |

| DCA Bot | Buys a little bit on a schedule. Ignores the chaos. |

| Arbitrage Bot | Exploits price differences. Low risk, steady gains. |

| Martingale | Buys more as price drops, sells everything when it recovers. |

| Infinity Grid | Grid bot but no ceiling. For believers. |

| Rebalancing | Keeps your portfolio split the way you want it. |

| Trailing Buy/Sell | Follows momentum. Rides waves. |

| + 9 more | Different flavors for different moods. |

Setup time: 5 minutes. Genuinely.

How:

- Go to pionex.com

- Sign up

- Deposit crypto (or buy with bank)

- Tap “Trading Bot” → pick one → AI fills in the settings

- Hit “Create”

- Touch grass

The tradeoff: Your crypto lives on their exchange. Only use money you’re okay losing.

Ease: ![]()

![]()

![]()

![]()

![]() | Power:

| Power: ![]()

![]()

![]()

![]()

![]()

2. OctoBot — Open Source That Doesn’t Look Like a Terminal

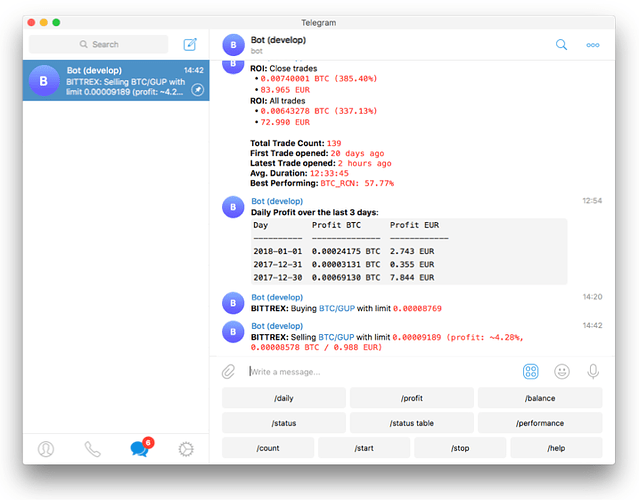

Self-hosted. Web interface. Mobile app. ChatGPT can help write your strategy. Wild.

Show me everything

Cost: Free if you self-host. ~$6/month if you want cloud.

Why it’s different:

- Actual web UI (not just command line)

- Phone app to check your bot

- Telegram alerts

- ChatGPT integration (yes, really)

- TradingView webhooks work

- Paper trading to test without risk

- Backtesting included

Exchanges: Binance, Bybit, OKX, Coinbase, Kraken, Hyperliquid, MEXC, more.

Three ways to set it up:

Way 1 — Cloud (braindead easy):

- Go to DigitalOcean Marketplace

- Search “OctoBot”

- Click “Create Droplet”

- Done. Web UI ready.

Way 2 — Docker (one command):

docker run -itd --name OctoBot -p 80:5001 -v $(pwd)/user:/octobot/user drakkarsoftware/octobot:stable

Open http://localhost — that’s it.

Way 3 — Just download it:

- Grab from github.com/Drakkar-Software/OctoBot/releases

- Double-click the file

- Browser opens automatically

Ease: ![]()

![]()

![]()

![]()

![]() | Power:

| Power: ![]()

![]()

![]()

![]()

![]()

![]() github.com/Drakkar-Software/OctoBot — 5.1k ★

github.com/Drakkar-Software/OctoBot — 5.1k ★

3. Freqtrade — The One Everyone Compares To

45,000+ stars. Massive community. Unlimited customization. You will need to learn some Python.

Show me everything

Cost: Free forever.

Why it’s the benchmark:

- Biggest community = most shared strategies

- FreqAI does machine learning optimization

- Backtesting that actually reflects reality

- Web UI exists (FreqUI)

- Telegram bot support

- Runs on a potato

Why people look for alternatives:

- Custom strategies require Python

- Setup is 30-60 minutes

- Learning curve exists

Docker setup (the easy way):

mkdir ft_userdata && cd ft_userdata

curl https://raw.githubusercontent.com/freqtrade/freqtrade/stable/docker-compose.yml -o docker-compose.yml

docker compose pull

docker compose run --rm freqtrade create-userdir --userdir user_data

docker compose run --rm freqtrade new-config --config user_data/config.json

docker compose up -d

Web UI at http://localhost:8080

Translation: It’s powerful. It’s free. It requires effort. Worth it if you’re serious.

Ease: ![]()

![]()

![]()

![]()

![]() | Power:

| Power: ![]()

![]()

![]()

![]()

![]()

![]() github.com/freqtrade/freqtrade — 45.7k ★

github.com/freqtrade/freqtrade — 45.7k ★

4. Hummingbot — The Only Free DEX Option

Trades on Uniswap. PancakeSwap. Real DeFi. $34 billion in user volume. Serious tool.

Show me everything

Cost: $0 (Apache 2.0 license)

What makes it different:

- Works on centralized AND decentralized exchanges

- Market making strategies built in

- Cross-exchange arbitrage

- Foundation-run (not some random repo)

- AI assistants can control it via MCP

Main strategies:

- Pure Market Making — be the liquidity

- Cross Exchange Market Making — hedge across platforms

- AMM Arbitrage — profit from CEX vs DEX price gaps

Setup:

git clone https://github.com/hummingbot/hummingbot.git

cd hummingbot

docker compose up -d

docker attach hummingbot

Real talk: Learning curve is steep. Command-line focused. Not for “make it easy” people. But if you want DEX trading automated? Only free option.

Ease: ![]()

![]()

![]()

![]()

![]() | Power:

| Power: ![]()

![]()

![]()

![]()

![]()

![]() github.com/hummingbot/hummingbot — 9.1k ★

github.com/hummingbot/hummingbot — 9.1k ★

THE HIDDEN GEMS

THE HIDDEN GEMS

Stuff that took actual digging. Not on page 1 of Google. Not in “Top 10” lists.

5. Passivbot — “Set and Forget” Grid Trading

Runs grid strategies with minimal babysitting. Has a built-in optimizer that evolves better settings automatically. Rust-powered speed.

Show me everything

The philosophy: Doesn’t try to predict direction. Just profits from volatility existing.

Features:

- Rust core = fast

- Evolutionary optimizer finds profitable settings for you

- “Forager” mode auto-picks the best markets

- Trailing entries and exits

- Works on: Bybit, Binance, OKX, Bitget, GateIO, KuCoin, Hyperliquid

License: Public domain. Do literally whatever you want with it.

Setup:

git clone https://github.com/enarjord/passivbot.git

cd passivbot

pip install -r requirements.txt

Configure api-keys.json, then:

python src/main.py configs/live/your_config.json

Needs: Rust installed. Config file tweaking. Not one-click, but not hard either.

Ease: ![]()

![]()

![]()

![]()

![]() | Power:

| Power: ![]()

![]()

![]()

![]()

![]()

![]() github.com/enarjord/passivbot — 1.8k ★

github.com/enarjord/passivbot — 1.8k ★

6. OpenTrader — Cleanest UI of Any Open-Source Bot

Looks like an actual product. Not a science project. npm install and you’re live.

Show me everything

Why it stands out: Someone actually cared about the interface.

Features:

- Real web UI from day one

- DCA, Grid, RSI strategies

- Paper trading mode

- Backtesting

- 100+ exchanges via CCXT

License: Apache 2.0

Setup:

npm install -g opentrader

opentrader init

opentrader up

UI at http://localhost:8000

That’s it. Three commands. Web interface. Done.

Ease: ![]()

![]()

![]()

![]()

![]() | Power:

| Power: ![]()

![]()

![]()

![]()

![]()

![]() github.com/Open-Trader/opentrader — 2.1k ★

github.com/Open-Trader/opentrader — 2.1k ★

7. hftbacktest — For The Obsessed

High-frequency backtester that models what other tools ignore: latency, queue position, order book depth. If you know what those words mean, this is for you.

Show me everything

The difference: Normal backtests assume your order fills instantly at the exact price you wanted. That’s fantasy. This models reality.

What it handles:

- L2/L3 order book reconstruction

- Latency simulation

- Queue position modeling

- Tick-by-tick data

- Python + Rust implementations

Setup:

pip install hftbacktest

Check examples/ for Binance Futures strategies.

Who this is for: Quants. Market makers. People who say “alpha decay” unironically. Not beginners.

Ease: ![]()

![]()

![]()

![]()

![]() | Power:

| Power: ![]()

![]()

![]()

![]()

![]()

![]() github.com/nkaz001/hftbacktest — 3.3k ★

github.com/nkaz001/hftbacktest — 3.3k ★

8. Superalgos — Drag-and-Drop Strategy Builder

No code. Literally drag boxes around to build trading logic. Has tutorials built into the app.

Show me everything

The appeal: Visual strategy design. If flowcharts make sense to you, this will too.

Features:

- Node.js based

- Built-in tutorials (actually helpful)

- Community shares strategies

- Multiple exchanges

- Backtesting + paper trading

Setup: Clone repo, run node run, follow the wizard.

Good for: Visual thinkers. People who learn by doing. Code-allergic individuals.

Ease: ![]()

![]()

![]()

![]()

![]() | Power:

| Power: ![]()

![]()

![]()

![]()

![]()

![]() github.com/Superalgos/Superalgos — 5.2k ★

github.com/Superalgos/Superalgos — 5.2k ★

9. Barter-rs — Pure Rust Trading Engine

For developers who want to build their own system from scratch. Not a bot — a framework.

Show me everything

What it is: Modular Rust components. Data feeds, execution, instruments — all separate. You assemble.

Why use it: Speed. Control. You’re building something custom and need solid foundations.

![]() github.com/barter-rs/barter-rs — ~400 ★

github.com/barter-rs/barter-rs — ~400 ★

10. NautilusTrader — Institutional Grade

What trading firms actually use. Multi-asset (crypto, forex, stocks, options). Overkill for most humans.

Show me everything

What it is: Professional trading platform. Rust + Cython + Python.

Why it exists here: If you’re building a fund or running serious money, this is the ceiling.

THE COMPARISON NOBODY ASKED FOR (But You Needed)

THE COMPARISON NOBODY ASKED FOR (But You Needed)

| Bot | Free? | Code? | Self-Host? | DEX? | Setup | Best For |

|---|---|---|---|---|---|---|

| Pionex | 5 min | Zero effort | ||||

| OctoBot | 10 min | GUI gang | ||||

| Freqtrade | Python | 45 min | Control freaks | |||

| Hummingbot | Some | 45 min | DeFi degens | |||

| Passivbot | Config | 30 min | Grid lords | |||

| OpenTrader | 10 min | UI snobs | ||||

| hftbacktest | Python | 15 min | Quant brains | |||

| Superalgos | 20 min | Visual learners |

SECURITY — READ THIS

SECURITY — READ THIS

Before you connect anything

Custodial (they hold your funds):

- Pionex

- Coinrule

- 3Commas

- Cryptohopper

Non-custodial (API keys only — funds stay on exchange):

- OctoBot

- Freqtrade

- Hummingbot

- Passivbot

- OpenTrader

- Everything self-hosted

Always do this:

Enable IP whitelisting on API keys

Enable IP whitelisting on API keys Disable withdrawal permissions

Disable withdrawal permissions Use exchange subaccounts if possible

Use exchange subaccounts if possible Start with paper trading

Start with paper trading Only risk what you’d be fine losing

Only risk what you’d be fine losing

JUST TELL ME WHICH ONE

JUST TELL ME WHICH ONE

“I have 5 minutes and want results”

→ Pionex. Sign up. Click buttons. Done.

“I want open-source but hate terminals”

→ OctoBot. Download. Double-click. Web UI.

“I want grid trading that runs itself”

→ Pionex (easy) or Passivbot (powerful)

“I want to trade on Uniswap/PancakeSwap”

→ Hummingbot. Only free option.

“I want maximum control, teach me”

→ Freqtrade. The standard for a reason.

“I’m building something serious”

→ NautilusTrader or Hummingbot

ALL LINKS

ALL LINKS

| Project | Link |

|---|---|

| Pionex | pionex.com |

| OctoBot | github.com/Drakkar-Software/OctoBot |

| Freqtrade | github.com/freqtrade/freqtrade |

| Hummingbot | github.com/hummingbot/hummingbot |

| Passivbot | github.com/enarjord/passivbot |

| OpenTrader | github.com/Open-Trader/opentrader |

| hftbacktest | github.com/nkaz001/hftbacktest |

| Superalgos | github.com/Superalgos/Superalgos |

| Barter-rs | github.com/barter-rs/barter-rs |

| NautilusTrader | github.com/nautechsystems/nautilus_trader |

Bots don’t print money. They execute strategies. Bad strategy + bot = automated losses.

Start with paper trading. Always.

Now stop reading and go set one up. ![]()

!

!